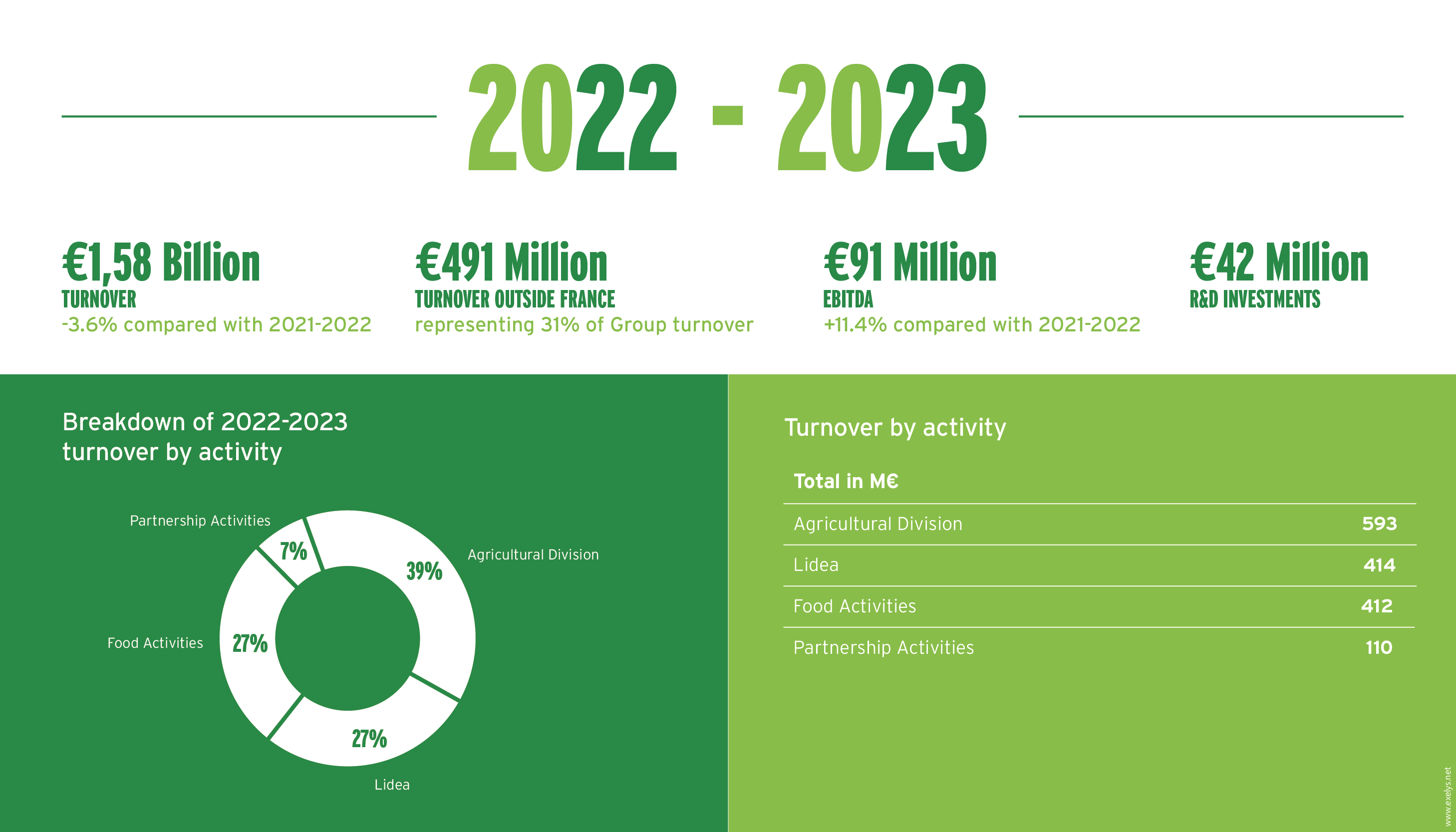

Over the 2022-2023 financial year, Euralis is improving its economic performance. EBITDA was €91 million, up €9 million on the previous year. The Group is reaffirming its strategic choices in favour of responsible agriculture and healthy, sustainable food. It is developing innovative products and solutions backed by substantial investment in Research and Development, totalling €42 million over the financial year.

Euralis has operated in a highly unstable environment marked by exceptional drought, persistent inflation, two successive outbreaks of bird flu (November 2022 and May 2023) and a conflict in Ukraine which has altered the major international balances (inflation, raw materials, exports, etc.). Group sales totalled €1.58 billion, down 3,6% on the previous year.

Key figures

Farming activities maintain their strategic course

In a year marked by drought and bird flu, agricultural activities have maintained their profitability levels and the roll-out of their strategic priorities. The sectors are continuing to be developed, with contractual plant production (vegetables, seeds, special maize, kiwifruit), up 9%. The 2022 autumn collection is down by 26%, and the livestock sectors have been impacted by drought and bird flu, respectively. The shift towards renewable energies has been confirmed. More than 100 contracts representing 18.5 peak megawatts have already been signed by Eurasolis, Euralis’s solar energy sector for farmers. In addition, the methanisation sector is being structured and developed as part of the BioBéarn project in partnership with TotalEnergies. Consulting and services for farmers continue to grow, with sales up 21%. 2,300 agronomic or strategic consulting services were provided to farmers this year. In addition, 730 farmers have committed to an environmental strategy (HEV, organic, regenerative agriculture, etc.). Point Vert shops recorded turnover growth of 5%. “Table des Producteurs” activities increased by 6%. This enables us to promote our members’ local production at our sales outlets. Always keen to adapt their organisation and skills to their markets, agricultural activities continue to invest in the training and the development of their teams. With a view to continually adapting and developing skills, 301 employees have taken training courses linked to the transformation of agricultural activities.

Lidea confirms its results, driven by high-performance genetics

The financial year was once again marked by the impact of the war in Ukraine, significant inflation and a downward trend in the European seeds market for maize. Against this backdrop, Lidea has maintained its position on the French grain maize market, helped by the promising results of its early-ripening varieties, which are particularly well-adapted to climate change. The production plan sown this year in France amounts to 24,000 hectares, which represents real added value for producers in Southwest France. For Lidea as a whole on the European continent, the production plan amounts to 57,000 hectares, up 20% on last year, mainly due to an ambitious sunflower plan. Business in Ukraine continues to be disrupted by the war. Maize sales are down 40%. However, Lidea is continuing to expand in various markets in Eastern Europe. During the year, Lidea invested more than 10% of its turnover in research and development at its 19 research stations in Europe. The teams guarantee a constant flow of genetic innovations and offer solutions to farmers who want to develop practices that are both profitable and positive for the environment: adapting to the climate, making the most of water resources, preserving soil, improving biodiversity, reducing input products, etc.

Euralis Gastronomie maintains its position

Euralis Gastronomie’s EBITDA rose in a financial year that was once again marked by the impact of bird flu (- €22 million for Euralis) and inflation (animal feed, energy, packaging). Turnover is down 10% due to the shortage of available ducks, which has led to new furlough schemes for processing sites. The Maison Montfort brand confirms its no. 2 position in supermarkets. It has adapted its organisation to provide the closest possible support to all players in the sector, from farmers to end customers. The Rougié brand continues to diversify. Following on from the Brittany blue lobster launched ten years ago, the chefs’ brand is now offering deep-frozen wild scallops. Despite the bird flu outbreaks, which limited availability, industrial and marketing investment was maintained. During the financial year, the proposed merger of the downstream duck business with Maïsadour was withdrawn from the French Competition Authority in August 2023. Nevertheless, this will remain essential to collectively tackle the structural challenges facing the industry.

Delicatessen activities are adapting to markets under pressure

As with most key players in the dry-cured meat and delicatessen sectors, inflation has had an impact on production costs in a market that is itself under pressure from consumers looking to save money on their food expenditure (27% of customers say they visit local food stores less often). Faced with these declining market volumes, delicatessen activities generated positive economic performance, albeit down on the previous year. It has stepped up its efforts to reconcile product superiority, flexibility and cost control. The year was marked by product innovations (sliced savoury cakes, soufflés, etc.) and successful launches (Provençal-style tomatoes, mini aperitif sausages, etc.). The Teyssier and Perpezac Le Noir dry-cured meat brands remain benchmarks for professionals, winning medals and prizes at the General Agricultural Competition and the Mondial Rabelais du Saucisson competition. The year was also marked by significant industrial investment, particularly in the savoury pastry workshop (puff pastries, sliced savoury cakes, croques, soufflés and quiches) at Yffiniac. This should help strengthen delicatessen activities in this market.

Christophe Congues, farmer and president of the Euralis Group

“For farmers, the 2022-2023 financial year was once again uncertain. With the effects of climate change, inflation, rising energy costs, bird flu outbreaks and so on, there have been many causes for concern. Against this backdrop, our cooperative has been working hard to provide farmers with the best possible support. We are offering our farmers new production contracts, in partnership with our downstream industrial clients. We are working on creating new outlets, including solar energy production. Finally, we are promoting and accompanying the roll-out of vaccination campaigns against bird flu for ducks, which will give farmers in the sector greater peace of mind.”

Philippe Saux, CEO of Euralis

“We operate in an unstable environment, and we are constantly adapting by transforming our organisations to be as agile as possible in the face of external crises. The Group’s economic performance was satisfactory, thanks to the exceptional mobilisation of our teams, who were able to take responsive and effective measures during the year. We are continuing to roll out our strategies with the same ambition: to strengthen responsible farming in our regions and offer healthy, sustainable food. At the same time, we remain alert to opportunities and partnerships that could strengthen our activities, which are undergoing profound change. The recent signing of our agreement with Bonduelle for the creation of the pulses sector and the integration of IntHy in the Eurasolis share capital are two noteworthy examples of this commitment.”

Press contact : Nathalie Salmon: 06.48.08.52.88- nathalie.salmon@euralis.com

HOME

HOME